how much taxes are taken out of a paycheck in ky

Total income taxes paid. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

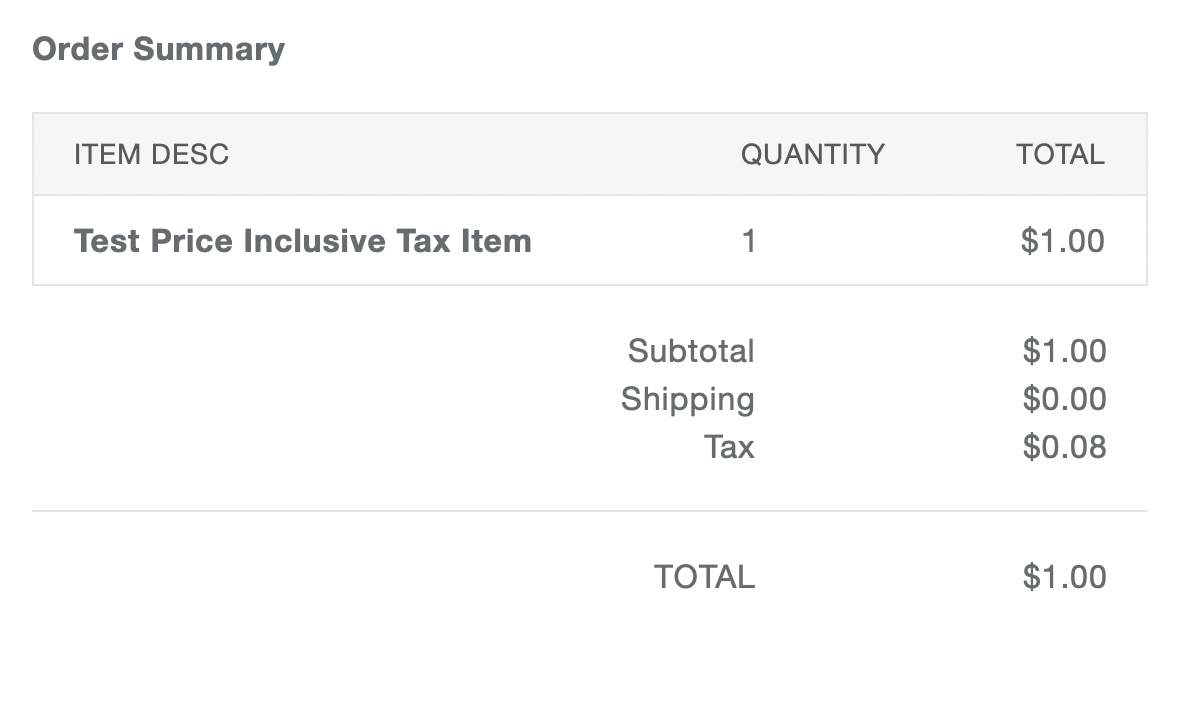

What Is Local Income Tax Types States With Local Income Tax More

103 KAR 18150 To register and file online please visit wrapskygov.

. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. 1200 after tax is 1200 NET salary annually based on 2021 tax year calculation. A 2020 or later W4 is required for all new employees.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Figure out your filing status. Most goods and many services are subject to that rate.

Workers in Kentucky who earn 8000 or more are in the 58 percent tax bracket of their wages in the form of state taxes. Switch to Kentucky hourly calculator. Kentucky Salary Paycheck Calculator.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. 8 New or Improved Tax Credits and Breaks for Your 2020 Return. The wage base is 11100 for 2022 and rates range from 05 to 95.

How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Kentucky paycheck calculator. You pay the tax on only the first 147000 of your earnings in 2022.

Overview of Kentucky Taxes. Amount taken out of an average biweekly paycheck. How much taxes are taken out of a paycheck in ky Monday June 6 2022 Edit.

Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks.

Any income exceeding that amount will not be taxed. But the income threshold for the low levels of taxation is very low. State W 4 Form Detailed Withholding Forms By State Chart Kentucky Paycheck Calculator Smartasset.

Workers in Kentucky who earn 8000 or more are in the 58 percent tax bracket of their wages in the form of state taxes. Check out our new page Tax Change to find out how federal or. Total income taxes paid.

1200 after tax breaks down into 10000 monthly 2300 weekly 460 daily 058 hourly NET salary if youre working 40 hours per week. Take Home Pay for 2022. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks.

The income tax brackets in the state of Kentucky are fairly narrow ranging from 2 percent for the lowest income workers to a high of 6 percent. Amount taken out of an average biweekly paycheck. Unless youre in construction.

Fast easy accurate payroll and tax so you save time and money. What is 1200 after taxes. 606 920-2039 Bowling Green 201 West Professional Park Court.

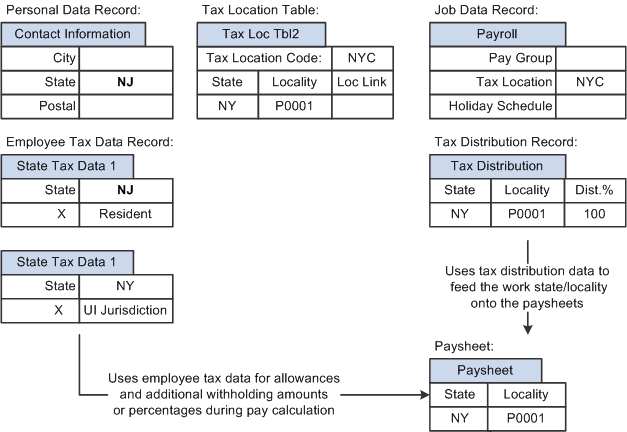

Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. Both employers and employees are responsible for payroll taxes. Kentucky Hourly Paycheck Calculator.

So the tax year 2021 will start from July 01 2020 to June 30 2021. If youre a new employer youll pay a flat rate of 27. This Kentucky hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Our calculator has been specially developed in order to provide the users of the calculator with not only. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. Kentucky State Unemployment Insurance SUI As an employer youre responsible for paying state unemployment insurance which covers those unemployed through no fault of their own.

2022 Federal State Payroll Tax Rates For Employers Paycheck Calculator Kentucky Ky Hourly Salary. For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount. Thanks to Kentuckys system of local occupational taxes there are no local sales tax rates throughout the state.

Kentucky Salary Paycheck Calculator. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223. Now you claim dependents on the new Form W-4.

That means that the states sales tax rate of 6 is the only sales tax youll pay in Kentucky regardless of what city youre shopping in. Effective May 5 2020 Kentuckys tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods beginning on or after January 1 2021. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

2022 Federal State Payroll Tax Rates For Employers

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Where Your Tax Dollar Goes Cbc News

2 000 After Tax Us Breakdown July 2022 Incomeaftertax Com

50 Mileage Log Form For Taxes Ufreeonline Template

Everything You Need To Know About Restaurant Taxes

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Payroll Tax What It Is How To Calculate It Bench Accounting

2022 Federal State Payroll Tax Rates For Employers

Payroll Tax What It Is How To Calculate It Bench Accounting

Kentucky Tax Rates Rankings Kentucky State Taxes Tax Foundation

How Far Back Can The Irs Go For Unfiled Taxes

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)